MIT Sloan Management Review, October 18, 2022

by Theodore Kinni

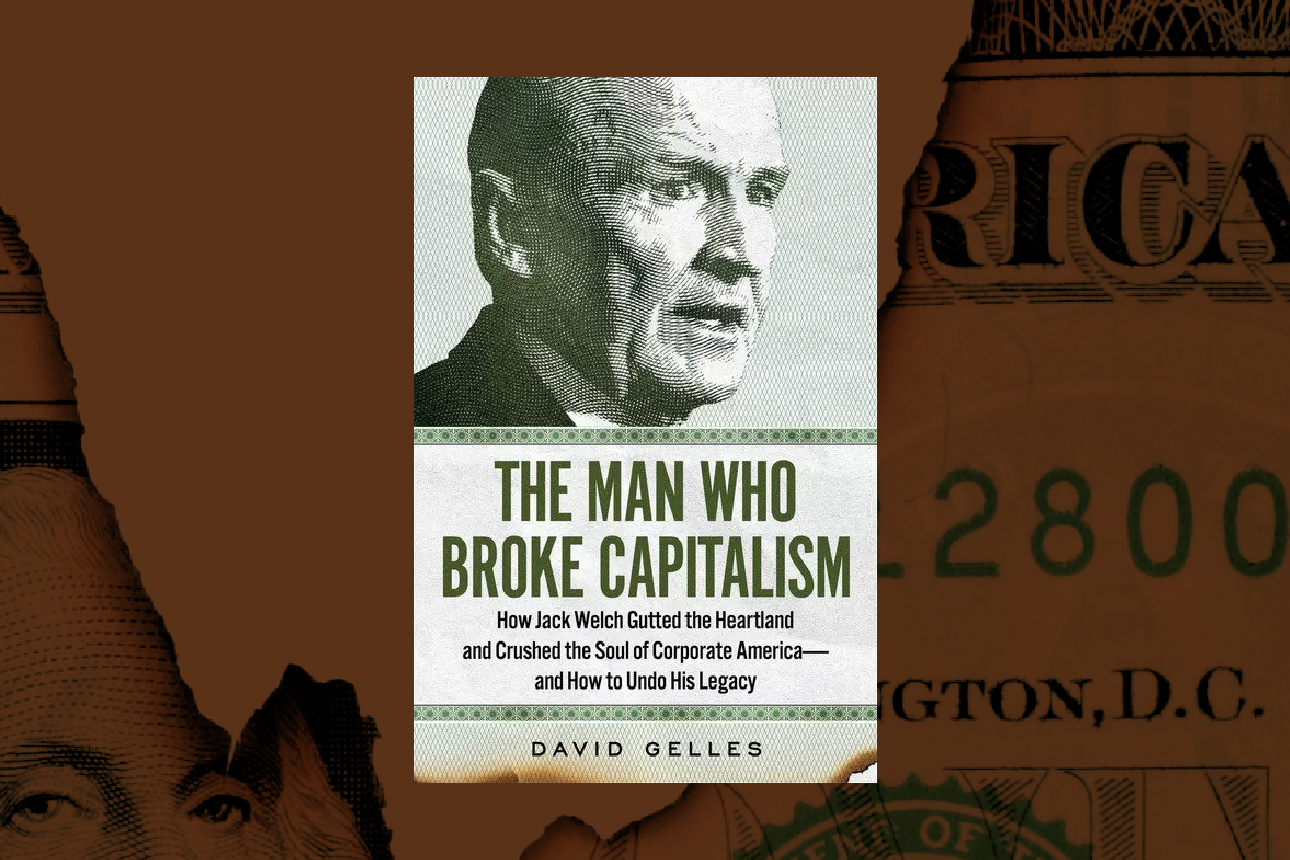

“The history of the world is but the biography of great men,” wrote 19th-century Scottish historian Thomas Carlyle. With The Man Who Broke Capitalism, New York Times business reporter David Gelles attempts to resuscitate the hoary “great man” theory of leadership in a backhanded sort of way. He calls out the late Jack Welch, the General Electric CEO whom Fortune magazine anointed “manager of the century” in 1999, as the evil mastermind behind the litany of economic woes rooted in shareholder capitalism gone wild, but he pays scant attention to their root causes.

When Welch took up the reins at GE in 1981, it was not a prosperous time in America’s economic history. The post-World War II boom was on its last legs: America’s industrial giants were sinking under their own weight, and foreign companies, especially those from Japan and Germany, were making inroads the size of superhighways into the U.S. consumer market. GE, then one of the nation’s leading companies, was languishing in the slow growth environment too.

If you were in business in the 1980s and ’90s, Gelles’s recounting of Welch’s tenure at GE will be a familiar story. “Neutron Jack” cut head count and instituted an annual employee ranking scheme that required that employees in the lowest decile be fired. The company’s business units had to be No. 1 or 2 in their market or they were jettisoned. Meanwhile, Welch chased new growth opportunities in financial services and media — soon, GE Capital alone accounted for more than half of the company’s profits.

The results? “During [Welch’s] tenure, GE posted annualized share price growth of about 21% a year, far outpacing the S&P 500 even during a historic bull market,” writes Gelles. “When Welch took over, GE was worth $14 billion. Two decades later, the company was worth $600 billion — the most valuable company in the world.” Read the rest here.

Tuesday, October 18, 2022

Did Jack Welch Blow Up the Business World?

Posted by

Theodore Kinni

at

12:41 PM

![]()

Labels: bizbook review, corporate success, leadership, management

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment