Insights by Stanford Business, January 15, 2025

by Theodore Kinni

There’s an old saw — cribbed from Plato and popularized by Douglas Adams — that those people who are most interested in leading others are least suited to the task. That’s not entirely accurate, yet new research has found a grain of truth in this idea: Many leaders have plenty of ambition to lead, but that’s no guarantee others think they’re effective.

“Our society assumes that there is a link between leadership ambition and leadership aptitude,” explains Francis Flynn, a professor of organizational behavior at Stanford Graduate School of Business. People seeking power and success step up to take leadership roles, and how we select leaders rewards that ambitiousness. “We largely rely on opt-in mechanisms to populate our pools of potential leaders — the people who apply to business schools like Stanford or seek a promotion to the next level in their organizations,” Flynn says. “That assumes implicitly that those people who want to lead are the ones who should lead. But is that assumption valid?”

Though it is clear that ambition plays a significant role in who becomes a leader, its link to leadership effectiveness has not been extensively studied. So Flynn, with Shilaan Alzahawi and Emily S. Reit, PhD ’22, undertook the first systematic study of that relationship. Read the rest here.

Wednesday, January 15, 2025

Don’t Confuse Ambition With Effective Leadership

Posted by

Theodore Kinni

at

10:10 AM

0

comments

![]()

Labels: career, corporate success, human resources, Insights by Stanford Business, leadership, management

Monday, December 9, 2024

ASX 100 CFOs Unlocked: Identifying the Leadership Advantage that counts

Learned a lot lending an editorial hand here:

Spencer Stuart, December 2024

by Jean E. Chiswick and Lucy Smith-Stevens

A senior leadership position, one pivotal to company performance, has undergone a profound shift.

Today’s chief financial officer (CFO) must influence beyond financial issues and offer cross-enterprise leadership on a range of different challenges. The role requires strong communication — someone able to seamlessly switch from internal to external audiences on a range of contemporary industry themes. They have to deftly navigate opportunities and risks, juggle a myriad of stakeholders and be co-pilot to the chief executive, working shoulder to shoulder in many cases, both inside and outside of the company.

No wonder the CFO so often looms large as a strong candidate when a CEO succession is underway.

But it’s not always smooth sailing.

The last two years have been pockmarked by a variety of economic challenges, increased complexity and ambiguity, as well as intense geopolitical disruption. Perhaps unsurprisingly, we have observed a shift in ASX 100 CFOs appointed with more proven CFO track records, classical accounting backgrounds and established credibility in public markets.

Does this mark a return to linear pathways to ASX 100 CFO succession? Well, not necessarily. We have found that 25% of internal CFO promotions have had exposure to P&L or operational leadership positions. This shows that breadth of experience is still important.

With more proven CFOs appointed in ASX 100 CFO positions, coupled with growing CEO succession from CFO roles, one thing is clear: an experienced CFO is the leadership advantage that counts. (Read the rest here.)

Posted by

Theodore Kinni

at

1:22 PM

0

comments

![]()

Labels: ASX 100, career, CFO, corporate success, management

Thursday, February 15, 2024

Why It’s Good for Business When Customers Share Your Values

by Daniel Aronson

Carolyn Geason-Beissel/MIT SMR | Getty Images

Values matter. Too often, however, they are relegated to the realm of fables instead of finance.

Take honesty, for example. We tell our children the story of the boy who cried wolf to teach them that when someone is dishonest, others are less likely to believe them the next time. But if we look just a tiny bit below the surface, the financial cost of the boy’s dishonesty immediately comes into focus: It results in the loss of his family’s entire flock of sheep.

If we calculated the loss caused by the boy crying wolf, we undoubtedly would find that it dramatically outweighed the combined gains generated by strategies like using AI-optimized grazing patterns, feeding the sheep a high-growth diet, or using consultant-recommended wool-marketing strategies. And yet, while all those things would clearly be considered business decisions, acting on values is not. But that’s wrong.

There is a very strong business case for acting on values. A $100 billion company I worked with discovered that there was a high return on investment from acting on its values and making sure customers knew about that. In fact, the return was many times greater than the ROI from its investments in upgraded technology or marketing campaigns. Yet the importance of technology and marketing are clearly understood as key areas of the business, while values-related impacts are left off of spreadsheets and are rarely — if ever — used to determine which actions have the highest ROI. Read the rest here.

Posted by

Theodore Kinni

at

2:11 PM

0

comments

![]()

Labels: book adaptation, corporate success, ethics, sustainability

Tuesday, November 28, 2023

Moving Beyond Net Zero to Nature Positive

Learned a lot lending an editorial hand here:

Boston Consulting Group, November 28, 2023

by Michel Frédeau, Torsten Kurth, Arun Malik, and Marine Swaab

On December 19, 2022, some 195 countries adopted the Kunming-Montréal Global Biodiversity Framework (GBF) aimed at halting and reversing the global decline of nature and biodiversity. The GBF established 23 targets, including those focused on the protection of freshwater and other ecosystems and the disclosure of biodiversity impacts by companies.

Nature is also at the heart of the COP28 agenda, with thematic programming that includes creating nature-positive cities, protecting and restoring marine and coastal ecosystems, and more.

The private sector will play a vital role in achieving the targets of the GBF. This means working to become nature positive—ensuring that the sum of an organization’s actions and impacts on nature will contribute to the reversal of the global decline in biodiversity by 2030, followed by full recovery by 2050. As our interviews with business and other leaders acting on the tenets of the nature positive movement indicate, the need to expand these efforts is pressing, and the financial first-mover advantage is likely considerable. We lay out an action plan for leaders to seize that advantage. Read the rest here.

Posted by

Theodore Kinni

at

1:03 PM

0

comments

![]()

Labels: climate change, corporate success, ecosystems, supply chain, sustainability

Monday, July 31, 2023

The art of the turnaround—circa 27 BC

strategy+business, July 31, 2023

Photograph by Viacheslav Peretiatko

The ranks of companies that have faced existential crises and succumbed are legion. When industries disappear and markets dry up, turnaround leaders who are charged with picking up the pieces and transforming for the future might find some perspective and inspiration in Virgil’s Aeneid.

“The song of the Aeneid is meant for moments when people desperately need to wrap their heads around an after that is shockingly different from the before they’d always known,” writes Andrea Marcolongo, an Italian journalist and former speechwriter for Prime Minister Matteo Renzi, in her book about the 2,000-year-old epic poem, Starting from Scratch: The Life-Changing Lessons of Aeneas (translated by Will Schutt). “In the parlance of forecasters: The Aeneid is warmly recommended reading for days when you’re in the eye of the storm without an umbrella.”

The Roman emperor Octavian commissioned Virgil to write the Aeneid at just such an unsettling moment. The Roman Republic had disintegrated into a series of civil wars, which eventually resulted in Octavian establishing himself as its first emperor in 27 BC. He wanted Virgil to create a piece of work that reinforced his claim to power and reassured the empire’s subjects about their prospects under his rule. Virgil did this by linking Octavian’s divine authority to the origin story of Rome.

The reluctant hero of this tale is Aeneas, the son of a prince and the goddess Venus, a character Virgil borrowed from Homer. In Homer’s Iliad, Aeneas fights in the Trojan War against the Greeks. In the Aeneid, Troy has fallen after a long siege (that darn horse).

As Aeneas surveys the wreckage, he steels himself for a fight to the death. At this moment, Venus appears and tells him to face reality. The gods have abandoned Troy, she says, Aeneas should salvage what he can and save his family and companions. Her son is still reluctant to give up on Troy, until the ghost of his dead wife prophesizes that in doing so, he will eventually “come to Hesperia’s land, where Lydian Tiber flows in gentle course among the farmers’ rich fields. There, happiness, kingship and a royal wife will be yours.” Finally, Aeneas gets the message. He gathers his compatriots (the Aeneads); they build a fleet of boats and set sail. Therein lies the first lesson for turnaround leaders: when your industry or the markets your company depends upon are in ruins, don’t double down. Move on. Read the rest here.

Posted by

Theodore Kinni

at

9:46 AM

0

comments

![]()

Labels: change management, corporate success, leadership, strategy, strategy+business

Tuesday, June 13, 2023

Risk Intelligence and the Resilient Company

Learned a lot lending an editorial hand here:

MIT Sloan Management Review, June 13, 2023

by Ananya Sheth and Joseph V. Sinfield

Simon Prades

Business resilience is a dynamic property that is retrospectively measured by the stability and longevity of corporate value across changing contexts. In real time, it manifests in an enterprise’s timely adaptation to both immediate and gradual changes in the business environment.

Our work, which employs a complex adaptive systems view of businesses, shows that resilience derives from three fundamental adaptive capacities: sensing and monitoring, to recognize emerging changes in the business environment; business model portfolio development, to build and test capabilities across operating contexts; and fundamental capability development, to drive growth with longevity and avoid corporate stall. Moreover, each of these capacities hinges on the development of a capability for risk intelligence.

We define risk intelligence as the honed ability to rigorously interpret risks and the consequences or opportunities they pose for a company. It allows leaders to see through environmental complexity and systematically identify, categorize, and interpret risks. This enables them to look beyond known risk factors and intentionally explore yet-to-be-known risks, thereby embracing rather than avoiding uncertainty. Importantly, risk intelligence brings recognition that individual risks or the forms in which they manifest matter far less than the often-shared consequences they have on a company’s value exchange system — that is, the manner in which it manages, identifies, creates, conveys, delivers, captures, protects, and sustains value. And finally, it provides leaders with a network view of risks that enables more effective allocation of risk mitigation resources by illuminating not just the direct consequences of risks but the manner in which they could cascade across the company’s value exchange system. In this article, we break down risk intelligence into actionable elements that leaders can pursue to help toughen their organizations for the long term. Read the rest here.

Posted by

Theodore Kinni

at

8:30 AM

0

comments

![]()

Labels: corporate success, management, risk management

Wednesday, April 12, 2023

The Missing Discipline Behind Failure to Scale

Learned a lot lending an editorial hand here:

MIT Sloan Management Review, April 12, 2023

by Andy Binns and Christine Griffin

Dan Page/theispot.com

Over the next few years, Best Buy Health tested its key assumptions about the opportunity, seeking out the sweet spot that would allow it to build a new business to sit alongside the company’s existing retail franchise. By 2022, it was a $525 million business, projected to grow at a 35% to 45% compound annual growth rate through 2027. The initiative created a new growth vector for its parent company and gave it a measure of resilience in the turbulent consumer retail sector.

Best Buy succeeded where many companies fail. It moved through the three innovation disciplines required to build new businesses: ideation, incubation, and scaling. It came up with a new idea for solving the customer problem of aging safely at home, incubated it by running in-market experiments to test value propositions, and then scaled it to a revenue-generating business unit. This is a relatively rare accomplishment. Our research finds that while 80% of companies claim to ideate and incubate new ventures, only 16% of companies successfully scale them.

A key contributor to this problem is the almost exclusive focus that companies place on the first two innovation disciplines. The ways and means of ideation and incubation — embodied in methodologies such as design thinking and lean startup, and disseminated by an army of trainers and consultants — are well known and readily available. However, when it comes to scaling, there are few methodologies to guide corporate decision-making.

Scaling is the missing innovation discipline. Indeed, when we assessed the innovation frameworks used by 15 large corporate incubation units, we found that only four mentioned scaling. For example, one large IT company’s incubation unit has a highly evolved process for ideation, validation, and incubation, but its framework stops at scaling. Scaling is considered outside the remit of such units: It becomes the kind of blind spot that author Douglas Adams characterized as “somebody else’s problem.” This leaves a critical gap in the ability of companies to build new businesses. After all, ideation and incubation generate value only when scaling succeeds.

To learn how to bridge this gap, we studied Best Buy and 30 other successful and unsuccessful corporate ventures. We found that most of the successful companies followed a similar approach to scaling new ventures that we call a scaling path. It requires a clarity of ambition; an understanding of the assets needed to access the customers, capabilities, and capacity required by the new business; and a willingness to use a variety of techniques to assemble those assets into a coherent strategy for attaining scale. Best Buy, for example, leveraged its existing assets — its stores, customers, and Geek Squad technical assistance team — and combined them with a $2.2 billion investment in acquisitions to scale its health business.

In this article, we offer five key lessons for building a scaling path that are drawn from both successful and unsuccessful corporate ventures. Read the rest here.

Posted by

Theodore Kinni

at

2:16 PM

0

comments

![]()

Labels: corporate success, innovation, new ventures

Friday, March 3, 2023

Beware the Pitfalls of Agility

Learned a lot lending an editorial hand here:

MIT Sloan Management Review, March 3, 2023

by Bernadine J. Dykes, Kalin D. Kolev, Walter J. Ferrier, and Margaret Hughes-Morgan

Given the panoply of recent disruptions — including COVID-19, inflation, Russia’s invasion of Ukraine — it’s no surprise that many leaders are striving to quickly dial up the agility level of their companies. Indeed, the ability to rapidly adapt to changing conditions can be a shield against disruption and a healing prescription for crisis. But organizational agility is not a panacea. There are pitfalls in the pursuit of agility that can and do produce unintended consequences.

Agility is a multidimensional concept that comprises three sequential and interrelated processes: alertness to the need for change, the decision to make the change, and the mobilization of the organizational resources required to execute the change. Our agility research and observations regarding the behavior of companies, especially during the pandemic, revealed that each process contains a pitfall that can subvert its outcomes: Alertness harbors the pitfall of hubris, decision-making harbors the pitfall of impulsiveness, and mobilization harbors the pitfall of resource fatigue. Read the rest here.

Posted by

Theodore Kinni

at

7:50 AM

0

comments

![]()

Labels: agility, corporate success, management

Friday, February 24, 2023

Why Digital Ability Trumps IQ

Learned a lot lending an editorial hand here:

MIT Sloan Management Review, February 24, 2023

by Kimberly A. Whitler and F.D. Wilder

In 2013, as fast-emerging digital technologies and channels were creating a sea change in consumer product marketing, A.G. Lafley, then CEO of Procter & Gamble, acted to ensure that the consumer packaged goods giant would not be left behind. He appointed F.D. Wilder, one of this article’s coauthors, as global head of e-business and tasked him with driving digital transformation across P&G’s many brands. The goal of this initiative was to develop and integrate P&G’s digital marketing abilities, e-commerce channels, and IT platforms — driving up sales, profit margins, and cash flow in the process.

As the e-business team considered this challenging mandate, it focused on the digital marketing ability of P&G’s brand and business managers as a key enabler of the transformation. Unfortunately, the team found that the literature regarding digital transformation tends to give short shrift to the capability of leaders: It focuses mainly on raising the “digital IQ” of the workforce — that is, the measurement of how much an organization can profit from digital and technological solutions.

Digital IQ has its limitations as an effective measure of ability, not the least of which is its strong emphasis on teaching and testing for generic vocabulary and knowledge. Yet digital and other transformational efforts nearly always require employees to work in new and unfamiliar ways. To ensure that they can do this new work, leaders must be able to assess employee ability by connecting it not only to knowledge and skills but also to targeted actions and performance outcomes. Only then can they identify and activate pockets of strength in the digital ability of employees and isolate and remediate pockets of weakness. Read the rest here...

Posted by

Theodore Kinni

at

11:13 AM

0

comments

![]()

Labels: change management, corporate success, digitization, performance management, transformation

Monday, January 30, 2023

A goal isn’t a mission

strategy+business, January 30, 2023

by Theodore Kinni

Illustration by VectorInspiration

There are missions, and then there are missions. One type of mission is an achievable task with a fixed goal that is often tactical and short-term in nature. The other mission is a high-level aspiration that provides direction and motivation to an organization over a long period of time. Leaders who mix up the two can put the future of their companies at risk.

The distinction between the two types of missions is dramatically illustrated in the recording of a White House meeting held on 21 November 1962. During the meeting, President John F. Kennedy and NASA’s chief administrator, James Webb, whom Kennedy appointed, had a heated argument about NASA’s proper mission.

It had been 18 months since Kennedy had called out a piloted moon landing as one of his top priorities in a special address to Congress, declaring, “First, I believe that this nation should commit itself to achieving the goal, before this decade is out, of landing a man on the moon and returning him safely to the Earth.” Now, Kennedy was considering whether he could move the target date for the first lunar landing from 1967 to 1966, and he was grilling NASA’s leaders about the feasibility and costs of doing so.

As they wrangled over the size of the special appropriation that would be needed to fund an accelerated schedule, Kennedy suddenly tacked. “Do you think this program is the top-priority program of the agency?” he asked Webb.

“No, sir, I do not,” answered Webb. “I think it is one of the top-priority programs….” With that, an argument began that revealed the chasm between Kennedy’s view of NASA’s mission and Webb’s view. Read the rest here

Posted by

Theodore Kinni

at

11:01 AM

0

comments

![]()

Labels: corporate success, leadership, motivation, NASA, strategy+business

Wednesday, January 25, 2023

Rethinking Hierarchy

Learned a lot lending an editorial hand here:

MIT Sloan Management Review, January 25, 2023

by Nicolai J. Foss and Peter G. Klein

Chris Gash/theispot.com

For all the hype and promise swirling around the idea of eliminating management to create agile, flat organizations, bosses and corporate hierarchies have remained extremely resilient. As we argued in the pages of MIT Sloan Management Review in 2014, under the right conditions, having such hierarchies in place is the best way to handle the coordination and cooperation problems that beset human interactions. They allow human intelligence and creativity to flourish on a larger scale. They provide a larger structure, with predictability and accountability, for specialists to do their work.

But that doesn’t mean traditional, command-and-control organizations are right for today’s environment. We see a confluence of business and social trends influencing the development of new kinds of hierarchies. Rapid technological progress, instant communication, value creation based on knowledge rather than physical resources, globalization, and a more educated workforce require us to rethink how we wield managerial authority. Meanwhile, individual views on politics, religion, and culture also inform our attitudes toward hierarchies — such as whether we value autonomy or admire authoritarian figures. All of these factors point to a new, different role for hierarchy to play in meeting the challenges of the 21st century.

The key challenge for designing and operating hierarchies today and tomorrow is to balance two opposing forces. The first is the desire, common to us all, for empowerment and autonomy, which helps companies mobilize employees’ creativity and exploit their unique knowledge and capabilities. The other is the need — particularly in environments characterized by rapid change and interdependent activities across the enterprise — to exercise managerial authority on a large scale.

Companies need clear, fairly enforced policies and procedures that achieve coordination and cooperation while respecting employee desires for empowerment and relative autonomy. Managers have to figure out when to intervene and when to let employees handle problems themselves.

These are tough issues without easy solutions. Which decisions should be decentralized (or delegated)? How much discretion should employees have over the decision areas delegated to them? How are these employees incentivized and evaluated? How do executives make sure that all these decentralized decisions mesh together? A central lesson of theories and evidence on organizational structure is that there are no universally “best” answers to these questions, only trade-offs that depend on the contingencies facing the company. Identifying and acting on those trade-offs — not decentralizing everything, everywhere — is the key to successful leadership. Read the rest here.

Posted by

Theodore Kinni

at

10:39 AM

0

comments

![]()

Labels: bizbooks, corporate success, management

Tuesday, January 10, 2023

Can bossless management work?

strategy+business, January 10, 2023

by Theodore Kinni

Photograph by Tom Werner

If you’ve been feeling like your leadership contributions are underappreciated, add a copy of Why Managers Matter to your reading list. In it, Nicolai Foss, a strategy professor at the Copenhagen Business School, and Peter Klein, the W.W. Caruth Chair and professor of entrepreneurship at the Hankamer School of Business, Baylor University, examine the various iterations of manager-free organizations that have been proposed—and occasionally adopted—over the past 50 years or so. Their conclusion: nonsense!

Foss and Klein lump the ideas of management thinkers, such as Gary Hamel, Michele Zanini, and Frederic Laloux, and approaches to decentralized management, such as holacracy and agile, into what they call the bossless company narrative. “The basic thrust of the genre is that while bosses are still around, the less control they exercise the better,” they write. “What the Harvard historian Alfred D. Chandler Jr. called the ‘visible hand’ of management should give way to worker autonomy, self-organizing teams, outsourcing, and an egalitarian office culture.”

Then the duo bales the entire genre into something resembling a straw man and puts a match to it. “The near-bossless companies—and there aren’t many of them—with their self-managing teams, empowered knowledge workers, and ultra-flat organizations are not generally or demonstrably better than traditionally organized ones,” declare Foss and Klein. “Bosses matter, not just as figureheads but as designers, organizers, encouragers, and enforcers.”

Foss and Klein make a detailed and extended case against the bossless company narrative with which it is hard to take issue, especially in the realm of large enterprises. Schemes like holacracy, in which decisions are made by teams, may work for small companies with distributed ownership, such as boutique consultancies and other kinds of partnerships, but they haven’t worked in large companies like Zappos, which have many more employees and require far more coordination. Agility, too, tends to work better for running projects than for running whole companies. In short, hierarchical management structures are, as the authors put it, “the worst form of organization—except for all the others.” Read the rest here.

Posted by

Theodore Kinni

at

8:46 AM

0

comments

![]()

Labels: bizbook review, bizbooks, corporate success, leadership, management, strategy+business

Monday, December 19, 2022

The Transparency Problem in Corporate Philanthropy

Learned a lot lending an editorial hand here:

MIT Sloan Management Review, December 19, 2022

Despite increasing demands by employees, investors, and communities for environmental, social, and governance transparency, philanthropy remains an often overlooked and almost entirely opaque sphere of corporate activity. This is no small issue: In 2021, corporate giving in the U.S. alone is estimated to have exceeded $21 billion.

To explore the dimensions of this problem and understand the use of disclosures in corporate philanthropy more broadly, I studied transparency in the philanthropic foundations of Fortune 100 companies. These foundations are only the tip of the iceberg in corporate giving, but they are indicative of the state of philanthropic transparency across the business world. The research revealed the difficulties that leaders and stakeholders face in trying to gauge the efficacy of giving, ensure accountability for it, and capture the full value it may offer to both the givers and recipients of corporate largesse.

Sixty-seven Fortune 100 companies operate active private foundations. In 2019, their combined grants approached $2.3 billion, which was directed to a variety of causes, including health and social services, community and economic development, education, civic and public affairs, arts and culture, the environment, and disaster relief.

There is no comprehensive set of disclosure protocols for company-sponsored foundations in any of the major international standards, such as the Global Reporting Initiative’s sustainability reporting framework. However, there is an extensive set of disclosure protocols for foundations in the nonprofit sector, including having a searchable grants database, sharing a categorized grant list, and providing online access to the 990-PF tax forms they file, which list grant amounts and the names of their recipients.

My analysis of the foundation and corporate websites of the Fortune 100, as well as their foundation and corporate social responsibility (CSR) reports, revealed that the vast majority of the companies do not follow any of the three protocols (a searchable database, a categorized grant list, or online 990-PFs). Only 4.5% of the companies provide a searchable grant database, only 7.5% offer a categorized grants list, and just 7.5% provide online access to their 990-PF filings. Read the rest here.

Posted by

Theodore Kinni

at

8:34 AM

0

comments

![]()

Labels: corporate success, CSR, management, philanthropy, transparency

Tuesday, December 13, 2022

Employee resource groups are more than “food, fun, and flags”

strategy+business, December 13, 2022

by Theodore Kinni

Photograph by MoMo Productions

In 1964, in the aftermath of race riots in Rochester, New York, Joseph Wilson, the CEO who transformed the Haloid Photographic Company into Xerox, invited Black employees to come together to address and remedy racial discrimination within the company. This group evolved into the National Black Employees Caucus, the first employee resource group (ERG). A half-century later, ERGs are a ubiquitous feature of the corporate landscape.

“ERGs have formed within the workplace to support and represent people with identities and demographics related to gender, race, sexual orientation, ability/disability, caregiver roles, military status, religious affiliation, generation, geographic area, job function, and more,” writes diversity, equity, and inclusion consultant and coach Farzana Nayani in The Power of Employee Resource Groups. In this handbook, Nayani offers practical advice to leaders of companies and ERGs who want to ensure that the time and resources they invest in their own groups are well spent.

“There is much debate as to whether affinity groups and ERGs are simply there to celebrate ‘food, fun, and flags,’” writes Nayani. But that’s a reductionist view, she says, one that ignores a host of potential benefits ERGs can provide to employees, companies, and communities. Nayani ticks them off: support, opportunities, and a voice for marginalized employees; enhanced leadership development and innovation pipelines; better employee engagement; increased reputational capital for the company; and more inclusive and socially responsible corporate behaviors that can deliver dividends to the communities in which businesses operate.

The key to achieving these benefits, says Nayani, is forging an explicit connection between a company’s ERGs and its organizational goals in five areas: workforce, workplace, marketplace, community, and suppliers. “Each of these five pillars is an area of focus where employee resource groups can offer contributions and also receive the benefits of efforts focused on the key themes,” she adds. Read the rest here.

Posted by

Theodore Kinni

at

10:24 AM

0

comments

![]()

Labels: bizbook review, corporate life, corporate success, diversity, inclusion, management, strategy+business

Thursday, December 8, 2022

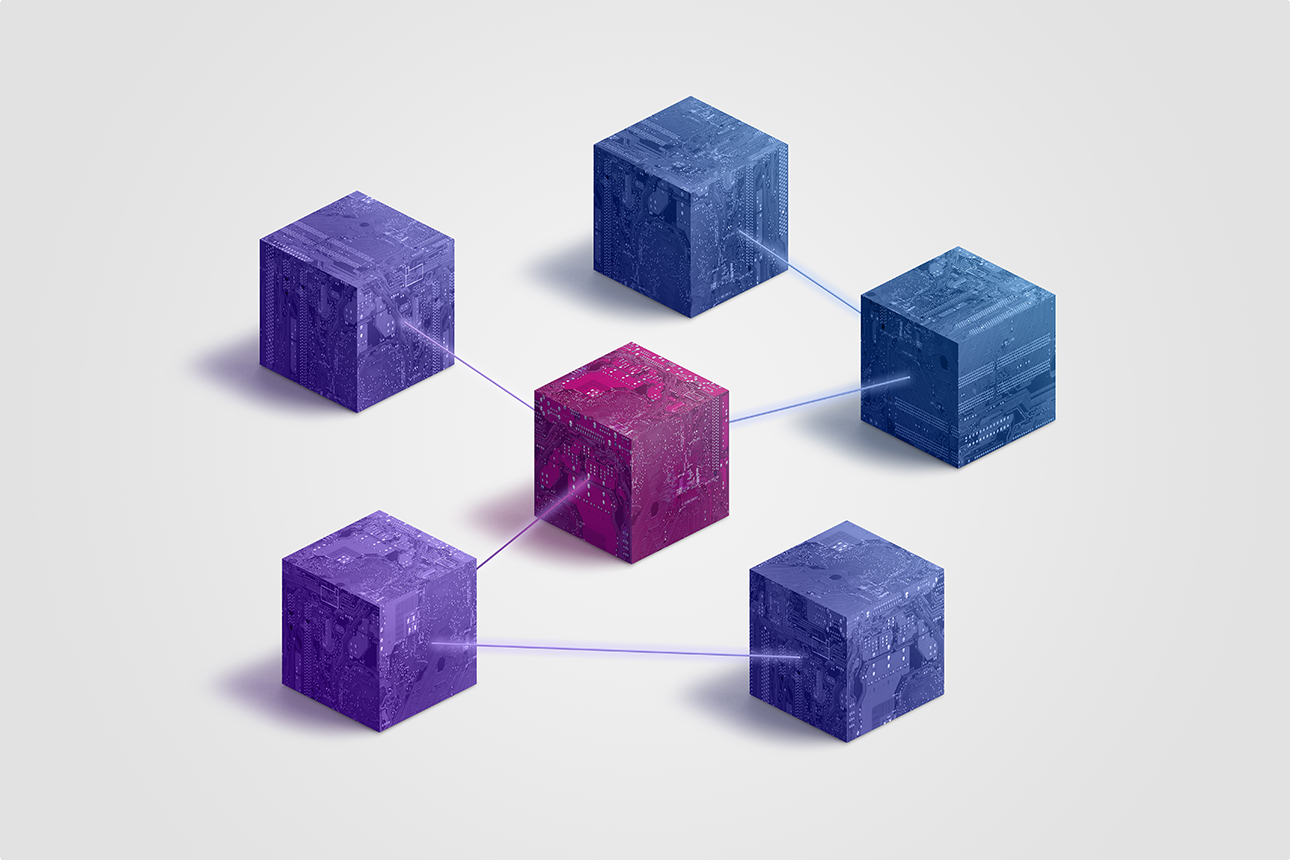

It’s Time to Take Another Look at Blockchain

MIT Sloan Management Review, December 8, 2022

Ravi Sarathy, interviewed by Theodore Kinni

It wasn’t long after the developers of bitcoin first used a distributed ledger to record transactions in 2008 that the blockchain revolution was announced with all the fanfare that usually accompanies promising new technologies. Then, as often happens with emerging technologies, blockchain’s promise collided with developmental realities.

Now, a decade and a half down the road, that early promise is becoming manifest. In his new book, Enterprise Strategy for Blockchain: Lessons in Disruption From Fintech, Supply Chains, and Consumer Industries, Ravi Sarathy, professor of strategy and international business at the D’Amore-McKim School of Business at Northeastern University, argues that distributed ledger technology has matured to the point of enabling a host of applications that could disrupt industries as diverse as manufacturing, medicine, and media.

Sarathy spoke with Ted Kinni, senior contributing editor of MIT Sloan Management Review, about the state of blockchain, the applications that are most relevant now for large companies, and how their leaders can harness the technology before established and new competitors use it against them.

MIT Sloan Management Review: Blockchain has been slow to gain traction in many large companies. What’s holding it back?

Sarathy: Blockchain is a complex technology. It is often secured by an elaborate mathematical puzzle that is energy intensive and requires large investments in high-powered computing. This also limits the volume of transactions that can be processed easily, making it hard to use blockchain in a setting like credit card processing, which involves thousands of transactions a second. Interoperability is another technological challenge. You’ve got a lot of different protocols for running blockchains, so if you need to communicate with other blockchains, it creates points of weakness that can be hacked or otherwise fail.

Aside from the technological challenges, there is the issue of cost and benefit. Blockchain is not free, and it’s not an easy sell. It requires significant financial and human resources, and that’s a problem because it’s hard to convince CFOs and other top managers to give you a few million dollars and a few years to develop a blockchain application when they do not have clear estimates of expected returns or benefits.

Lastly, there are organizational challenges. A blockchain is intended to be a transparent, decentralized network in which everyone talks to each other without any intermediaries organized in a world of hierarchies. Making that transition can require a long philosophical and cultural leap for traditional companies used to a chain of command. Trust, too, becomes a huge issue, particularly when you start adding independent firms to a blockchain. Read the rest here.

Posted by

Theodore Kinni

at

7:47 AM

0

comments

![]()

Labels: bizbooks, blockchain, corporate success, innovation, technology

Tuesday, December 6, 2022

Preparing Your Company for the Next Recession

Learned a lot lending an editorial hand here:

MIT Sloan Management Review, December 6, 2022

by Donald Sull and Charles Sull

Winter is coming: Inverted yield curves, rising interest rates, and a rash of layoff announcements have convinced many economists that the global economy is headed for a downturn. Recessions are bad for business, but downturns are not destiny.

The worst of times for the economy as a whole can be the best of times for individual companies to improve their fortunes. One study found that lagging companies are twice as likely to overtake industry leaders during a recession, relative to nonrecessionary periods. Another study, of nearly 4,000 global companies before, during, and after the Great Recession, found that the top decile of companies grew earnings by 17% per year during the downturn, while the laggards saw profits stagnate or decline. The difference between the companies in the two groups translated into $6 billion in enterprise value on average.

How can the same recession cause some corporate empires to rise and others to fall? The short answer is that uncertainty surges dramatically during recessions — increasing roughly threefold at the company level compared with the relative calm before or after a downturn.

“Chaos isn’t a pit,” explains Petyr “Littlefinger” Baelish in Game of Thrones. “Chaos is a ladder.” The chaos of a recession, however, is both a pit and a ladder. In the face of uncertainty, some companies retrench. They abandon attractive customers and promising markets, offload valuable assets at fire sales, cut prices, and seek new partners to bolster cash flow. Others start climbing. They seize opportunities and improve their fortunes.

Our research has identified three fundamental ways to manage uncertainty: resilience, local agility, and portfolio agility. Leaders can take a series of steps, such as building a strong balance sheet or diversifying cash flows, to boost an organization’s resilience and ability to withstand environmental shocks. Local agility is the ability of individual business units, functions, product teams, and geographies to respond quickly and effectively to changes in their specific circumstances.

Portfolio agility is an organization’s capability to quickly and effectively shift resources across different parts of the business. While local agility enables individual teams to spot and seize opportunities, portfolio agility enables the company as a whole to double down on its most promising investments. Portfolio agility is, by some estimates, the largest single driver of revenue growth and total shareholder returns for large companies. Quickly and effectively reallocating resources is valuable at any point in the business cycle, but it’s decisive during downturns, when internal cash flows dwindle and access to external funding dries up.

Resilience and agility are effective in isolation, but in combination, their impact is turbocharged. In the midst of a downturn, resilient companies can weather the storm to wait for opportunities to arise. Having a high level of resilience — by building a war chest of cash or obtaining secure access to funding — provides an organization with the wherewithal to fund emerging opportunities, but only if it is agile enough to seize those opportunities. Resilience without agility may ensure survival but will not position a company for future growth. Agile companies without resilience, in contrast, often lack the resources to exploit the opportunities they spot. Read the rest here.

Posted by

Theodore Kinni

at

8:49 AM

0

comments

![]()

Labels: corporate success, leadership, management, strategy

Tuesday, November 29, 2022

Three Ways Companies Are Getting Ethics Wrong

Learned a lot lending an editorial hand here:

MIT Sloan Management Review, November 29, 2022

by David Weitzner

Making business decisions that are both ethically and strategically sound has always been incredibly tricky. Leaders are called upon to act in a manner that is consistent with their personal values, builds solidarity and trust among diverse stakeholders, enhances their company’s reputation, and prevents scandals, while also being mindful of the bottom line.

This leadership challenge is getting ever more complex. Investors are measuring companies against environmental, social, and corporate governance (ESG) indexes. Employees are demanding extensive diversity, equity, and inclusion (DEI) commitments. And customers want to buy brands that are tied to strong corporate social performance (CSP).

As counterintuitive as it might seem in the burgeoning ethical complexity of ESG, DEI, and CSP, a few companies have found that when it comes to ethics, simpler is better. They meet the demands listed above by rejecting the notion that ethics are necessarily complex. They refuse to abdicate their ethical responsibilities; they craft value propositions that do not lean on social value initiatives to obscure or distract from how the company creates financial value; and they are transparent about how they do business with all stakeholders. Read the rest here.

Posted by

Theodore Kinni

at

8:28 AM

0

comments

![]()

Labels: articles to ponder, corporate success, DEI, ethics, sustainability

Monday, November 7, 2022

Get Ready for the Next Supply Disruption

Learned a lot lending an editorial hand here:

MIT Sloan Management Review, November 7, 2022

by M. Johnny Rungtusanatham and David A. Johnston

Michael Austin/theispot.com

The COVID-19 pandemic has ushered in an era of supply chain disruption and unpredictability that has severely challenged many companies’ planning and processes, and revealed how far prevailing practices are from the ideal. An MIT Center for Transportation and Logistics poll conducted online at the onset of the pandemic revealed that only 16% of organizations had an emergency response center — an established best practice for mitigating and recovering from unplanned interruptions in the physical flow of goods.

Unsurprisingly, given the pandemic’s disruptive effects, the same poll found that the highest ambition of supply chain managers was to bolster their risk management protocols and tools. The problem with crisis-driven supply chain initiatives that are focused on protocols and tools is that they are only as effective as the ability of the organization to use them. Having that ability requires the systematic development of capabilities to manage for supply disruptions. These capabilities are combinations of people, policies, processes, and technologies that ensure companies can not only plan for and respond to known business and operating risks but also — and more importantly — manage unknown-but-knowable threats and their associated consequences.

We’ve identified six capabilities that fill this bill: anticipate, diagnose, detect, activate resources for, protect against, and track threats. Together, they constitute the ADDAPT framework, which is based on our research into how public agencies and private enterprises experience and respond to supply disruptions like the COVID-19 pandemic. In medicine, pathology is aimed at understanding the causes and effects of a disease to guide treatment. Similarly, the ADDAPT capabilities help companies understand the causes of supply disruptions and their immediate and long-term effects, in order to both respond to unfolding supply disruptions and prevent their recurrence. Read the rest here.

Posted by

Theodore Kinni

at

4:41 PM

0

comments

![]()

Labels: corporate success, management, supply chain

Tuesday, October 18, 2022

Did Jack Welch Blow Up the Business World?

MIT Sloan Management Review, October 18, 2022

by Theodore Kinni

“The history of the world is but the biography of great men,” wrote 19th-century Scottish historian Thomas Carlyle. With The Man Who Broke Capitalism, New York Times business reporter David Gelles attempts to resuscitate the hoary “great man” theory of leadership in a backhanded sort of way. He calls out the late Jack Welch, the General Electric CEO whom Fortune magazine anointed “manager of the century” in 1999, as the evil mastermind behind the litany of economic woes rooted in shareholder capitalism gone wild, but he pays scant attention to their root causes.

When Welch took up the reins at GE in 1981, it was not a prosperous time in America’s economic history. The post-World War II boom was on its last legs: America’s industrial giants were sinking under their own weight, and foreign companies, especially those from Japan and Germany, were making inroads the size of superhighways into the U.S. consumer market. GE, then one of the nation’s leading companies, was languishing in the slow growth environment too.

If you were in business in the 1980s and ’90s, Gelles’s recounting of Welch’s tenure at GE will be a familiar story. “Neutron Jack” cut head count and instituted an annual employee ranking scheme that required that employees in the lowest decile be fired. The company’s business units had to be No. 1 or 2 in their market or they were jettisoned. Meanwhile, Welch chased new growth opportunities in financial services and media — soon, GE Capital alone accounted for more than half of the company’s profits.

The results? “During [Welch’s] tenure, GE posted annualized share price growth of about 21% a year, far outpacing the S&P 500 even during a historic bull market,” writes Gelles. “When Welch took over, GE was worth $14 billion. Two decades later, the company was worth $600 billion — the most valuable company in the world.” Read the rest here.

Posted by

Theodore Kinni

at

12:41 PM

0

comments

![]()

Labels: bizbook review, corporate success, leadership, management

Tuesday, September 13, 2022

Manage Your Customer Portfolio for Maximum Lifetime Value

Learned a lot lending an editorial hand here:

MIT Sloan Management Review, September 13, 2022

by Fred Selnes and Michael D. Johnson

Traci Daberko/theispot.com

When we wrote about customer portfolio management (CPM) and our research into customer portfolio lifetime value (CPLV) for this publication in 2005, we emphasized the need to balance a “large, leaky bucket” of weaker customer relationships alongside closer and higher-value customer relationships. But according to our latest research, there is much more that businesses can and should be doing to drive future revenue. These actions depend on both market conditions and a company’s resources.

Growing a company’s customer portfolio requires continual investments across a range of weaker to stronger relationships. Our updated CPLV model shows that a clear understanding of when and how much to invest in, leverage, and defend different customer relationships is an essential determinant of both current and future revenues and costs.

Most companies lack a basis for developing this understanding. Business leaders seeking to optimally manage the ecosystem of customer relationships face a complex problem — and for most, de facto CPM practices are more likely to focus myopically on either current sales or their most valuable customers. However, our model shows that what’s really required is to integrate multiple dimensions (not just scale, but also variances in customers’ needs and wants) and tactics (relationship conversion, leverage, and defense) across the whole customer portfolio.

Our CPM framework and CPLV model enable executives to answer the following key questions as they seek to grow and optimize their company’s customer portfolio:

- How central is developing customer relationship strength to our strategy and competitive advantage? More specifically, when and how much should we invest in converting weaker relationships to stronger relationships?

- How do we leverage these investments once relationships are created?

- How do we protect the relationships we have created to minimize customer churn?

Our CPLV model illuminates how these relationships relate to the value proposition of a company by predicting a seller’s future revenues from and costs associated with the different relationship segments. These predictions are based on a set of parameters that includes market growth over the course of a product life cycle, unit cost over time, the cost and probability of deepening relationships, relationship premiums, and switching costs and probabilities. By running extensive simulations within the model, we have identified three explicit goals for an effective CPM growth strategy: relationship conversion, relationship leverage, and relationship defense. Read the rest here

Posted by

Theodore Kinni

at

11:24 AM

0

comments

![]()

Labels: corporate success, customer experience, management, marketing